(Bloomberg) -- Federal Reserve officials Friday stressed further interest-rate hikes are needed to tame inflation even though there are emerging signs that price pressures are cooling.

Atlanta Fed President Raphael Bostic said inflation is still too high and reiterated he favors raising interest rates above 5%, compared to the current level of just below 4.5%. Richmond Fed President Thomas Barkin, in separate remarks, said “we still have work to do” to bring price gains back to the Fed’s 2% goal.

In another speech, Fed Governor Lisa Cook highlighted several signs of easing inflationary pressures, including decelerating wage gains, while emphasizing that inflation remained far too high for the Fed’s liking.

They all spoke after two key data releases on Friday morning suggested the Fed’s efforts at taming inflation were working.

The government’s December jobs report showed US average hourly earnings rose 0.3% in December from a month earlier and 4.6% from December 2021 — both less than expected — after a downward revision to November. But job growth remained solid and the unemployment rate declined to 3.5% from 3.6%.

A separate release showed service industries were unexpectedly weak last month and price gains ebbed slightly.

What Bloomberg Economics Says...

“Momentum in the labor market may have picked up again after loosening somewhat toward the end of last year. Together with what we know about early revisions to benchmark data, that leads us to expect two more 25-basis-point rate hikes by the Fed, with the terminal rate reaching 5% in March.”

— Anna Wong and Eliza Winger, economists

To read more click here

Treasury yields plummeted on Friday and traders trimmed expectations for just how high the Fed might push its benchmark, while also shifting bets more toward a quarter-point hike rather than a half point at the next meeting, which takes place Jan. 31 and Feb. 1. Inflation data due next week could prove more decisive for the Fed’s next move.

Bostic, in an interview on CNBC, indicated he’s open to either a quarter-point or half-point move.

“Today, I’d be comfortable with either a 50 or a 25, and if I start to hear signs that the labor market is starting to ease a bit in terms of its tightness, then I might lean more in the 25 basis-point position,” Bostic said Friday during an interview with CNBC. His peak rate projection of 5% to 5.25% is “the range I think we need to move to if the economy proceeds as I expect which is continual gradual slowdown.”

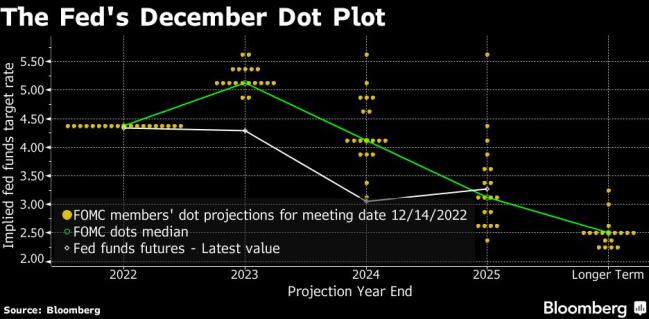

Fed officials raised rates by 50 basis points in December, moderating their pace of increases after four straight 75 basis-point moves, while signaling they expect to keep hiking in 2023.

The increase lifted their benchmark to 4.3% and officials projected rates peaking at 5.1%, according to their median forecast.

“They’re certainly going to continue to raise rates at the end of this month — likely continue to do that in March,” former Fed Governor Randall Kroszner told Bloomberg Surveillance following the jobs report. “But it may make it more likely that they go 25 basis points rather than 50 basis points at these meetings, I think that’s really where it’s going to be.”

“They’re certainly going to continue to buy insurance” against the risk that inflation will remain sticky amid a tight labor market, said Kroszner, an economics professor at the University of Chicago Booth School of Business, who called the data an “ immaculate disinflation report” because both wage growth and the unemployment rate declined.

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

GBP/USD

1.2475

-0.0015 (-0.12%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (10)

USD/JPY

157.91

+0.12 (+0.07%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

AUD/USD

0.6469

-0.0003 (-0.05%)

Summary

NeutralMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (2)

Sell (3)

USD/CAD

1.3780

+0.0003 (+0.03%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (7)

Sell (0)

EUR/JPY

168.32

+0.10 (+0.06%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

EUR/CHF

0.9808

+0.0001 (+0.01%)

Summary

NeutralMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (2)

Gold Futures

2,295.80

-7.10 (-0.31%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Silver Futures

26.677

+0.023 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (2)

Sell (10)

Indicators:

Buy (0)

Sell (9)

Copper Futures

4.5305

-0.0105 (-0.23%)

Summary

↑ BuyMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (8)

Sell (1)

Crude Oil WTI Futures

81.14

-0.79 (-0.96%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Brent Oil Futures

85.62

-0.71 (-0.82%)

Summary

↑ SellMoving Avg:

Buy (1)

Sell (11)

Indicators:

Buy (1)

Sell (7)

Natural Gas Futures

1.946

-0.009 (-0.46%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (5)

US Coffee C Futures

213.73

-13.77 (-6.05%)

Summary

↑ SellMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (0)

Sell (10)

Euro Stoxx 50

4,920.55

-60.54 (-1.22%)

Summary

↑ SellMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (1)

Sell (7)

S&P 500

5,035.69

-80.48 (-1.57%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

DAX

17,921.95

-196.37 (-1.08%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

FTSE 100

8,144.13

-2.90 (-0.04%)

Summary

SellMoving Avg:

Buy (5)

Sell (7)

Indicators:

Buy (2)

Sell (4)

Hang Seng

17,763.03

+16.12 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

US Small Cap 2000

1,973.05

-42.98 (-2.13%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

IBEX 35

10,854.40

-246.40 (-2.22%)

Summary

NeutralMoving Avg:

Buy (6)

Sell (6)

Indicators:

Buy (3)

Sell (3)

BASF SE NA O.N.

49.155

+0.100 (+0.20%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Bayer AG NA

27.35

-0.24 (-0.87%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (8)

Allianz SE VNA O.N.

266.60

+0.30 (+0.11%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (5)

Adidas AG

226.40

-5.90 (-2.54%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (7)

Deutsche Lufthansa AG

6.714

-0.028 (-0.42%)

Summary

NeutralMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (9)

Sell (1)

Siemens AG Class N

175.90

-1.74 (-0.98%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Deutsche Bank AG

15.010

-0.094 (-0.62%)

Summary

NeutralMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (6)

Sell (2)

| EUR/USD | 1.0658 | ↑ Sell | |||

| GBP/USD | 1.2475 | ↑ Sell | |||

| USD/JPY | 157.91 | ↑ Buy | |||

| AUD/USD | 0.6469 | Neutral | |||

| USD/CAD | 1.3780 | ↑ Buy | |||

| EUR/JPY | 168.32 | ↑ Buy | |||

| EUR/CHF | 0.9808 | Neutral |

| Gold | 2,295.80 | ↑ Sell | |||

| Silver | 26.677 | ↑ Sell | |||

| Copper | 4.5305 | ↑ Buy | |||

| Crude Oil WTI | 81.14 | ↑ Sell | |||

| Brent Oil | 85.62 | ↑ Sell | |||

| Natural Gas | 1.946 | ↑ Sell | |||

| US Coffee C | 213.73 | ↑ Sell |

| Euro Stoxx 50 | 4,920.55 | ↑ Sell | |||

| S&P 500 | 5,035.69 | ↑ Sell | |||

| DAX | 17,921.95 | ↑ Sell | |||

| FTSE 100 | 8,144.13 | Sell | |||

| Hang Seng | 17,763.03 | ↑ Sell | |||

| Small Cap 2000 | 1,973.05 | ↑ Sell | |||

| IBEX 35 | 10,854.40 | Neutral |

| BASF | 49.155 | ↑ Sell | |||

| Bayer | 27.35 | ↑ Sell | |||

| Allianz | 266.60 | ↑ Sell | |||

| Adidas | 226.40 | ↑ Sell | |||

| Lufthansa | 6.714 | Neutral | |||

| Siemens AG | 175.90 | ↑ Sell | |||

| Deutsche Bank AG | 15.010 | Neutral |

| Mua/Bán 1 chỉ SJC # So hôm qua # Chênh TG | |

|---|---|

| SJC Eximbank | 8,300/ 8,500 (8,300/ 8,500) # 1,298 |

| SJC 1L, 10L, 1KG | 8,300/ 8,520 (0/ 0) # 1,510 |

| SJC 1c, 2c, 5c | 7,380/ 7,550 (0/ 0) # 540 |

| SJC 0,5c | 7,380/ 7,560 (0/ 0) # 550 |

| SJC 99,99% | 7,370/ 7,470 (0/ 0) # 460 |

| SJC 99% | 7,196/ 7,396 (0/ 0) # 386 |

| Cập nhật 01-05-2024 10:45:19 | |

| Xem lịch sử giá vàng SJC: nhấn đây! | |

| ↀ Giá vàng thế giới | ||

|---|---|---|

| $2,285.72 | -47.5 | -2.04% |

| ʘ Giá bán lẻ xăng dầu | ||

|---|---|---|

| Sản phẩm | Vùng 1 | Vùng 2 |

| RON 95-V | 25.440 | 25.940 |

| RON 95-III | 24.910 | 25.400 |

| E5 RON 92-II | 23.910 | 24.380 |

| DO 0.05S | 20.710 | 21.120 |

| DO 0,001S-V | 21.320 | 21.740 |

| Dầu hỏa 2-K | 20.680 | 21.090 |

| ↂ Giá dầu thô thế giới | |||

|---|---|---|---|

| WTI | $80.83 | +3.39 | 0.04% |

| Brent | $85.50 | +3.86 | 0.05% |

| $ Tỷ giá Vietcombank | ||

|---|---|---|

| Ngoại tệ | Mua vào | Bán ra |

| USD | 25.088,00 | 25.458,00 |

| EUR | 26.475,36 | 27.949,19 |

| GBP | 30.873,52 | 32.211,36 |

| JPY | 156,74 | 166,02 |

| KRW | 15,92 | 19,31 |

| Cập nhật lúc 10:45:15 01/05/2024 Xem bảng tỷ giá hối đoái | ||